7 Powerful Job Opportunities for Semi-Qualified CA Students (How to Prepare, Where to Apply & Skills Needed)

Job Opportunities for Semi-Qualified CA Students

Semi-qualified CA students are more in demand today than ever before. Companies—whether startups, mid-size firms, MNCs, or Big 4s—actively hire candidates who have cleared CA Inter (1 or both groups) and have strong practical knowledge.

This guide gives you:

✅ Detailed job roles

✅ Skill requirements

✅ How to prepare

✅ Where and how to apply

✅ Resume + LinkedIn optimisation tips

✅ Salary expectations

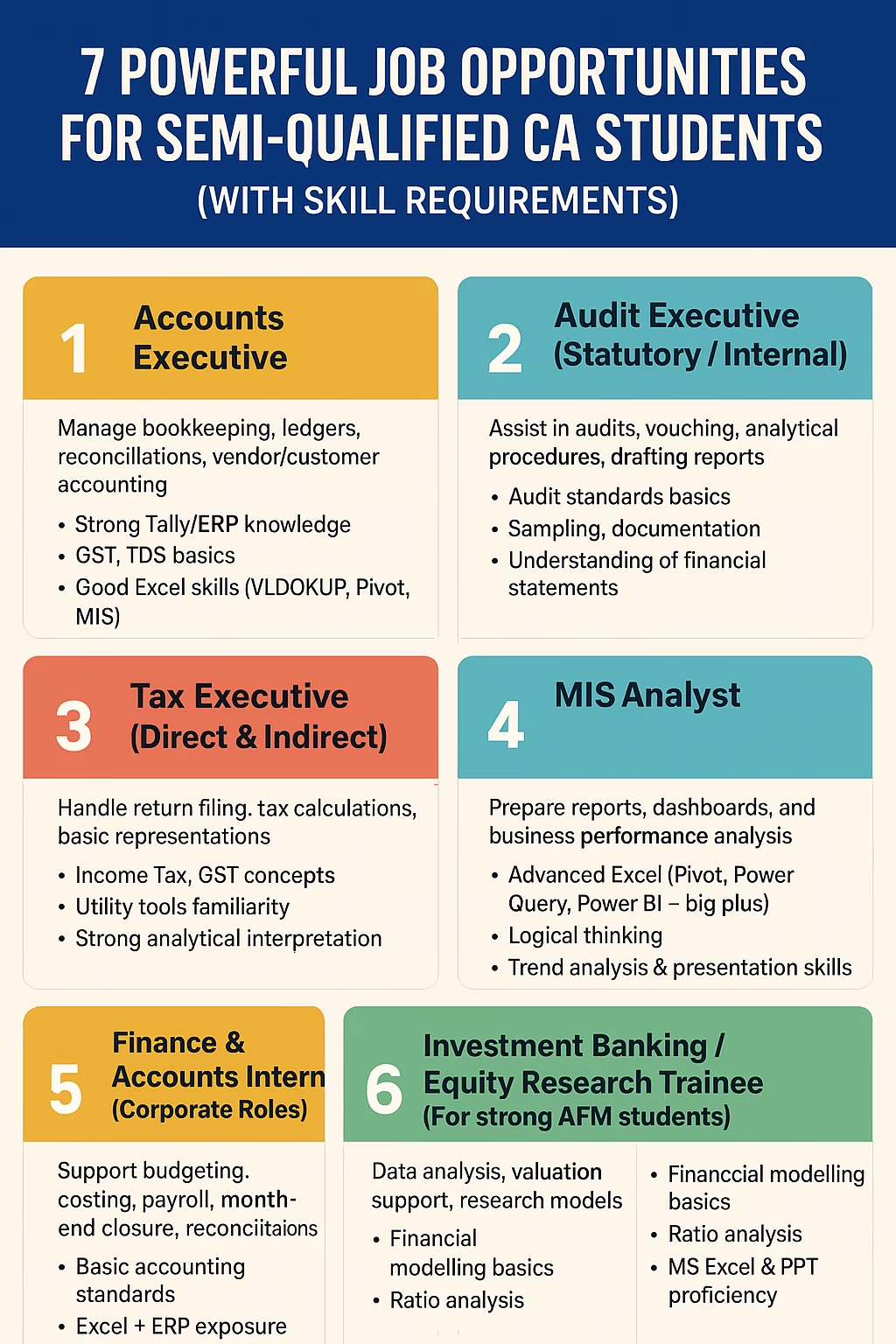

Powerful Job Opportunities for Semi-Qualified CA Students:

1. Accounts Executive (Most Common & Highest Demand)

What You Will Do

- Maintain daily accounting entries

- Bank & vendor reconciliation

- Ledger scrutiny

- GST & TDS working

- Invoice booking

- Month-end closing support

Skills Required

- Tally Prime / Zoho Books / SAP / Oracle basics

- Strong Excel: Pivot, VLOOKUP, SUMIFS

- GST + TDS practical knowledge

How to Prepare

- Practice actual Tally datasets (free practice data available online).

- Build sample Excel MIS files (Sales, Purchases, Debtors ageing).

- Revise GST working: RCM, ITC, 3B–GSTR 2A/2B matching.

Where to Apply

- Naukri (best for Accounts roles)

- LinkedIn Jobs

- Foundit (Monster)

- Local industrial areas (offline approach works fast)

- Direct company websites (Finance careers section)

Salary Expectation

₹18,000–35,000 per month (Fresh semi-qualified)

2. Audit Executive (Statutory & Internal Audit)

What You Will Do

- Vouching & verification

- Analytical review

- Testing internal controls

- Draft audit reports

- Support seniors during company audits

Skills Required

- Standards on Audit basics

- Sampling techniques

- Internal control understanding

- MS Excel (filters, pivot, audit tools)

How to Prepare

- Revise Audit cycles: Revenue, Purchases, Inventory, Payroll.

- Learn how to prepare a working paper file.

- Read sample statutory audit reports.

- Watch practical audit walkthrough videos (available free on YouTube).

Where to Apply

- Big 4: Deloitte, EY, KPMG, PwC

- Big 10 CA firms

- Mid-sized CA firms

- Fin-tech audit agencies

Salary Expectation

₹20,000–45,000 per month

3. Tax Executive (Direct & Indirect)

What You Will Do

- ITR preparation & filing

- GST return filing

- TDS return preparation

- Tax computation worksheets

- Replying to tax notices (basic level)

Skills Required

- Income Tax basics

- GST portal operations

- TDS provisions

- Excel-based computation

How to Prepare

- File practice ITRs using free income tax software.

- Practice preparing Form 3B, GSTR-1, and matching 2A/2B.

- Learn how to draft replies for basic GST mismatches.

- Do mock tax computations with past year data.

Where to Apply

- Tax consulting firms

- CA firms

- Corporate tax departments

- Startups needing compliance support

Salary Expectation

₹20,000–40,000 per month

4. MIS Analyst (High-Growth Role)

What You Will Do

- Business reporting

- Dashboards

- Sales, cost, margin analysis

- Forecasting & budgeting assistance

Skills Required

- Advanced Excel

- Power BI (huge advantage)

- Analytical mindset

- Data storytelling

How to Prepare

- Learn Excel Power Query + Power Pivot (free online courses available).

- Create Power BI dashboards (sales, finance).

- Study how to interpret business KPIs: margins, cost ratios, DSO, DPO.

- Practice preparing weekly MIS reports.

Where to Apply

- MNCs: Accenture, Wipro, Infosys

- Ecommerce companies

- Manufacturing units

- Startups

Salary Expectation

₹25,000–60,000 per month (skills-based)

5. Corporate Finance & Accounts Intern (MNC + Big Companies)

What You Will Do

- Support budgeting

- Month-end closing

- Variance analysis

- Fixed assets management

- Payroll support

Skills Required

- Basic Ind AS knowledge

- Strong Excel

- ERP exposure (SAP/Oracle beneficial)

- Communication skills (very important)

How to Prepare

- Learn how to prepare a budget sheet & variance analysis.

- Revise Ind AS 16, 2, 18, 115 basics only.

- Learn month-end closing steps.

- Prepare a professional corporate resume.

Where to Apply

- LinkedIn jobs (fastest)

- Company career portals

- Apna / Internshala for internships

- Through references (strong advantage)

Salary Expectation

₹20,000–45,000 per month

6. Investment Banking / Equity Research Trainee

What You Will Do

- Financial modelling

- Valuation support (DCF, IPO, M&A)

- Data analysis

- Sector research

Skills Required

- Excel modelling

- Ratio analysis

- Equity research formats

- PowerPoint presentations

How to Prepare

- Learn Financial Modelling (free YouTube playlists available).

- Build a sample model: DCF, Forecast FS.

- Study 3–4 company annual reports deeply.

- Make 2 sample equity research reports.

Where to Apply

- Boutique IB firms

- Startups in fintech

- Research agencies

- LinkedIn direct recruiter messages

Salary Expectation

₹25,000–60,000 per month

7. Compliance & ROC Assistant

What You Will Do

- MCA filings

- Board resolutions

- Company law compliance

- Drafting forms & documentation

Skills Required

- Companies Act basics

- ROC portal

- Drafting skills

- Maintaining registers

How to Prepare

- Learn SPICe+, DIR-3, AOC-4, MGT-7 basics.

- Practice drafting: Board meeting minutes, resolutions.

- Follow MCA updates regularly.

Where to Apply

- CS firms

- Compliance outsourcing firms

- CA firms with secretarial wings

Salary Expectation

₹15,000–35,000 per month

How to Apply for Job Opportunities for Semi-Qualified CA Students (Step-by-Step)

Step 1: Create a Professional Resume

Focus on:

- Articleship experience

- Software skills (Excel, Tally, SAP, Power BI)

- Audit / Tax / Accounts exposure

- 2–3 strong bullet points per assignment

If you want, create a perfect resume for you to apply for Powerful Job Opportunities for Semi-Qualified CA Students

Step 2: Optimise LinkedIn (Important)

✔ Add “Semi-Qualified CA” in headline

✔ Write skills: GST, TDS, Audit, Excel

✔ Post regularly about learning

✔ Connect with HRs of CA firms, MNCs, Big 4s

Step 3: Apply Daily on These Platforms

Best Platforms to apply for Job Opportunities for Semi-Qualified CA Students

- Naukri.com (Most vacancies for finance roles)

- LinkedIn Jobs

- Company websites

- Apna, Internshala (for internships)

Apply Timing (Critical Secret)

- Apply between 9 AM – 1 PM

- HRs shortlist fresh CVs in the morning

Step 4: Prepare for Interviews

Mostly asked for Powerful Job Opportunities for Semi-Qualified CA Students are

- Basics of GST/Income Tax

- Accounting entries

- Past articleship work

- Excel skills

- Why semi-qualified?

I can also prepare mock interview questions for you.

Step 5: Start with a Learning Mindset

Your first job is your real training and theese are the Powerful Job Opportunities for Semi-Qualified CA Students

After 1 year of experience → salary jumps 30–60%.

Conclusion on Powerful Job Opportunities for Semi-Qualified CA Students:

For Powerful Job Opportunities for Semi-Qualified CA Students must have excellent opportunities if they position themselves well. You only need:

- A strong resume

- Good practical skills

- Consistent applications

- Professional communication

Your CA knowledge plus real-world experience becomes a career-launching combination.

FAQs – on Job Opportunities for Semi-Qualified CA Students

1. What is the salary range for semi-qualified CA students?

Most roles start between ₹18,000–45,000 per month, depending on your skills, articleship experience, and city. MIS/IB roles can go up to ₹60,000 if your Excel & analytical skills are strong.

2. Can a semi-qualified CA get a job in Big 4?

Yes. Big 4 firms regularly hire CA Inter candidates for roles in audit, tax, advisory, and risk management, especially if you have strong articleship experience.

3. What skills should I learn to increase my salary quickly?

Top skills that boost salary fastest: Advanced Excel, GST/TDS, Power BI, Financial Modelling, and Ind AS basics. Even learning one of these can make a big difference.

4. Is Tally necessary to get a job?

For most accounting and compliance roles, yes. Even if companies use SAP/Oracle, Tally gives you essential accounting practical knowledge.

5. How many companies should I apply to per day?

Apply to 15–25 roles daily across Naukri, LinkedIn, and company portals. Early morning applications have the highest shortlisting chance.

6. Can a semi-qualified CA switch careers later (e.g., to finance or data roles)?

Absolutely. Many students move from accounts/audit to MIS, FP&A, equity research, or business analytics once they build Excel + analysis skills.

7. What should I highlight in my resume?

Focus on:

- Articleship exposure

- Skills (Excel, GST, Audit, Tally, SAP)

- Practical work done

- Certifications (if any)

Explore our CA Test Series – trusted by 10,000+ students to structure their study plans around real ICAI patterns. Make your preparation match your professional exposure.