10 Powerful Finance Certifications to Boost Your Resume in 2025 (Latest & Researched Guide)

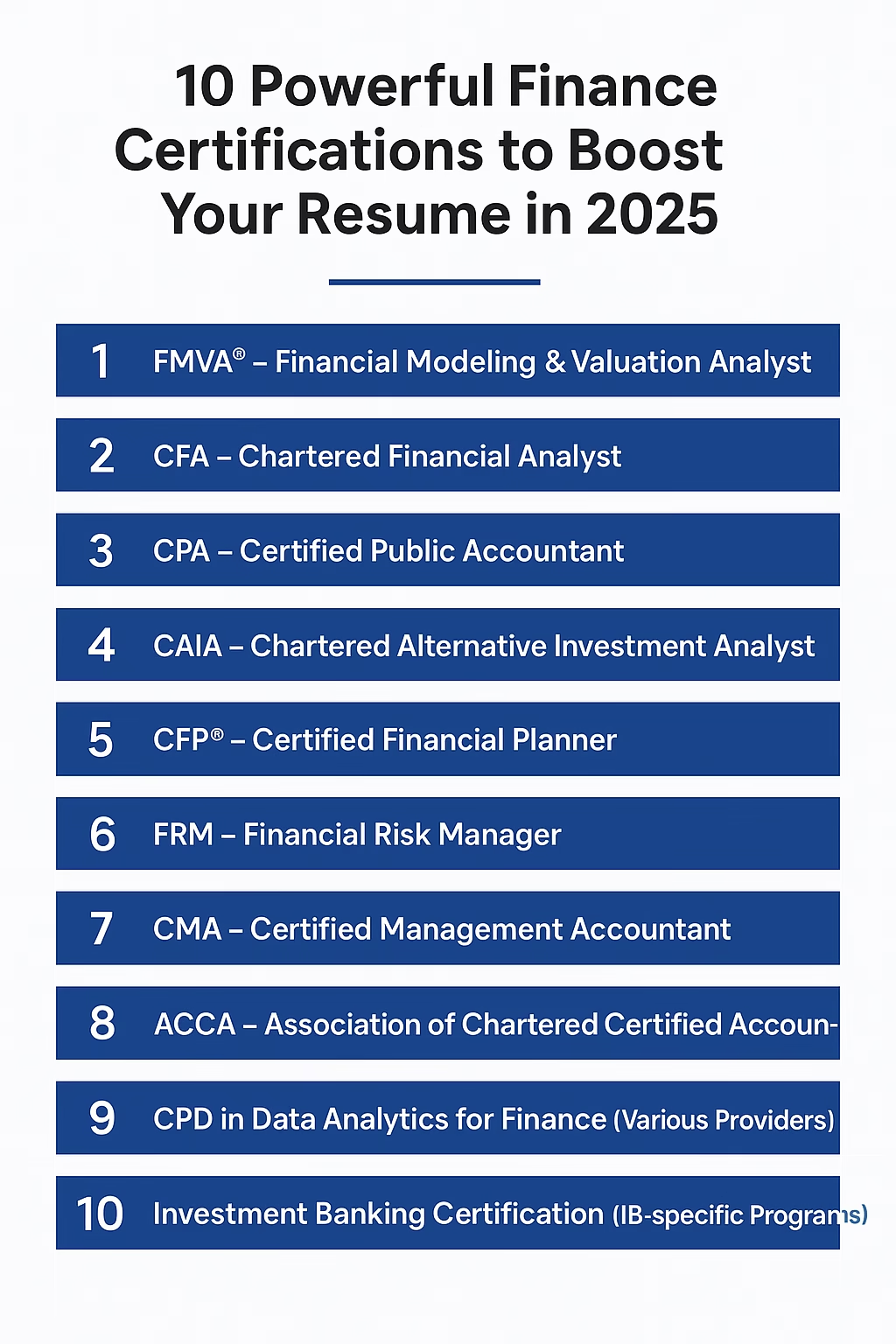

10 Powerful Finance Certifications to Boost Your Resume in 2025

The finance job market in 2025 is more competitive, tech-driven, and skill-focused than ever. Employers today don’t just want degrees — they want proof of practical skills, specialization, and industry-recognized competency.

That’s why earning a top finance certification can:

✔ Increase your salary potential

✔ Strengthen your domain expertise

✔ Open global job opportunities

✔ Help you transition into high-demand roles

Below is a completely original, realistic, and updated analysis of the 10 most powerful Finance Certifications to Boost Your Resume in 2025.

Finance Certifications to Boost Your Resume:

1. FMVA® – Financial Modeling & Valuation Analyst

Why it’s powerful in 2025:

Companies across industries want analysts who can build financial models, value businesses, forecast performance, and present insights — and FMVA focuses entirely on these practical, job-ready skills.

Best For:

Corporate finance, FP&A, equity research, investment banking (entry-level)

What It Builds:

- Excel-based financial modeling

- Three-statement models

- Valuation (DCF, multiples, transaction comps)

- Scenario & sensitivity analysis

- Executive dashboards

Key Highlights:

- Cost-effective, short duration

- Extremely practical

- No work experience required

2. CFA – Chartered Financial Analyst

Why it’s still the gold standard:

The CFA remains one of the most respected credentials in investment management, portfolio strategy, and capital markets.

Best For:

Asset management, research analysis, portfolio management, investment strategy

What It Builds:

- Deep capital markets knowledge

- Equity, fixed income, derivatives

- Portfolio theory

- Ethical and professional conduct

Strength:

No other certification matches the CFA’s breadth in investment analysis.

Note:

It is time-intensive (3–5 years), but long-term career impact is unmatched for Finance Certifications to Boost Your Resume .

3. CPA – Certified Public Accountant

Why employers value it:

CPA is considered the global benchmark for accounting accuracy, financial reporting, audit quality, and regulatory compliance.

Best For:

Audit, accounting, controllership, taxation, CFO track

What It Builds:

- GAAP/IFRS expertise

- Audit & assurance

- Taxation

- Corporate governance

- Risk controls

Strength:

Crucial for leadership roles in finance departments and best Finance Certifications to Boost Your Resume

4. CAIA – Chartered Alternative Investment Analyst

Why it’s gaining popularity:

Alternative assets — private equity, hedge funds, real assets — continue to grow rapidly. CAIA is the most recognized certification dedicated to this space.

Best For:

PE firms, hedge funds, alternative investment roles, asset management

What It Builds:

- Alternative asset valuation

- Fund structures & strategies

- Portfolio construction

- Due diligence

Strength:

Specialized, high-growth, and preferred by alternative investment firms.

5. CFP – Certified Financial Planner

Why it’s relevant:

With rising demand for wealth managers, CFP has become essential for professionals advising retail or HNI clients.

Best For:

Wealth advisory, banking, insurance, personal finance planning

What It Builds:

- Retirement planning

- Tax & estate planning

- Investment planning

- Client management

Strength:

Finance Certifications to Boost Your Resume for client-facing financial roles.

6. FRM – Financial Risk Manager

Why banks prefer it:

In 2025, risk management roles are expanding due to compliance, digital finance, and volatility. FRM is the most trusted certification for this domain.

Best For:

Credit risk, market risk, operational risk, risk analytics, regulatory roles

What It Builds:

- Quantitative risk analysis

- VaR, stress testing

- Basel norms

- Risk modeling

Strength:

Banks and global financial institutions actively look for FRM holders.

7. CMA (US) – Certified Management Accountant

Why it matters now:

Companies need finance professionals who can connect numbers with strategy. CMA focuses on managerial finance rather than accounting theory.

Best For:

Management accounting, budgeting, internal decision-making, corporate strategy

What It Builds:

- Cost management

- Budgeting & forecasting

- Financial planning

- Performance management

Strength:

Ideal for roles between finance and business strategy and helps in Finance Certifications to Boost Your Resume .

8. ACCA – Association of Chartered Certified Accountants

Why it’s globally valued:

ACCA provides a comprehensive foundation in accounting, taxation, audit, and financial management and is recognized in 180+ countries.

Best For:

Global accounting jobs, multinational companies, audit firms

What It Builds:

- Financial reporting

- Taxation & audit

- Financial management

- Corporate governance

Strength:

Excellent for those looking for international opportunities.

9. CPD in Data Analytics for Finance (Various Providers)

Why it’s essential in 2025:

Finance teams increasingly rely on data analytics, automation, and visualization tools. Many employers want analysts who can interpret large data sets.

Best For:

Financial analysts, FP&A roles, BI teams, fintech roles

What It Builds:

- SQL basics

- Power BI/Tableau

- Data storytelling

- Predictive modeling (beginner-level)

Strength:

Bridges the skill gap between traditional finance and modern analytics.

10. Investment Banking Certification (IB-specific Programs)

Many professionals now use IB-specific certifications to break into competitive roles without traditional backgrounds.

Best For:

Aspiring analysts in IB, private equity, valuation roles

What It Builds:

- Deal structuring

- Pitchbook creation

- M&A valuation

- IPO modeling

Strength:

Fast, practical pathway into investment banking and for Finance Certifications to Boost Your Resume .

Side-by-Side Comparison (Fresh, Updated & Simplified)

| Certification | Focus Area | Best For | Difficulty | Duration | Notable Strength |

|---|---|---|---|---|---|

| FMVA | Modeling, valuation | FP&A, IB | Low–Medium | <6 months | Practical, job-ready |

| CFA | Investments | Asset mgmt | Very High | 3–5 yrs | Deep market expertise |

| CPA | Accounting | Audit, CFO track | High | 18–24 months | Regulatory credibility |

| CAIA | Alternatives | PE/HF | Medium | 1–1.5 yrs | Niche investment expertise |

| CFP | Wealth mgmt | Advisors | Medium | 18–24 months | Client-focused planning |

| FRM | Risk mgmt | Banks | High | 1 yr | Risk specialization |

| CMA | Management finance | Corporate roles | Medium | 1 yr | Managerial finance skills |

| ACCA | Global accounting | MNCs | Medium | 2–3 yrs | International recognition |

| Data Analytics Cert | Analytics | FP&A/BI | Low | 2–6 months | Future-ready skills |

| IB Certification | IB prep | Investment banking | Medium | <6 months | Deal-focused expertise |

Final Conclusion: Which One Should You Choose?

Choose a certification based on your career direction, not popularity:

- Want to be an analyst? → FMVA + Data Analytics

- Want to be in investments? → CFA

- Prefer accounting & reporting? → CPA or ACCA

- Interested in risk? → FRM

- Private equity or hedge funds? → CAIA

- Client-facing career? → CFP

- Corporate strategic roles? → CMA

- Investment banking? → IB-focused certification

Your certification should match the skills you want to build and the career you want to pursue.

🔗 Join 10,000+ CA Students using our Test Series to study smarter and create your own academic brand. Structured tests with detailed feedback.