ABC Analysis of CA: 21 Powerful Insights to Crack CA Foundation, Inter & Final Exams

ABC Analysis of CA – What It Means for Your Success

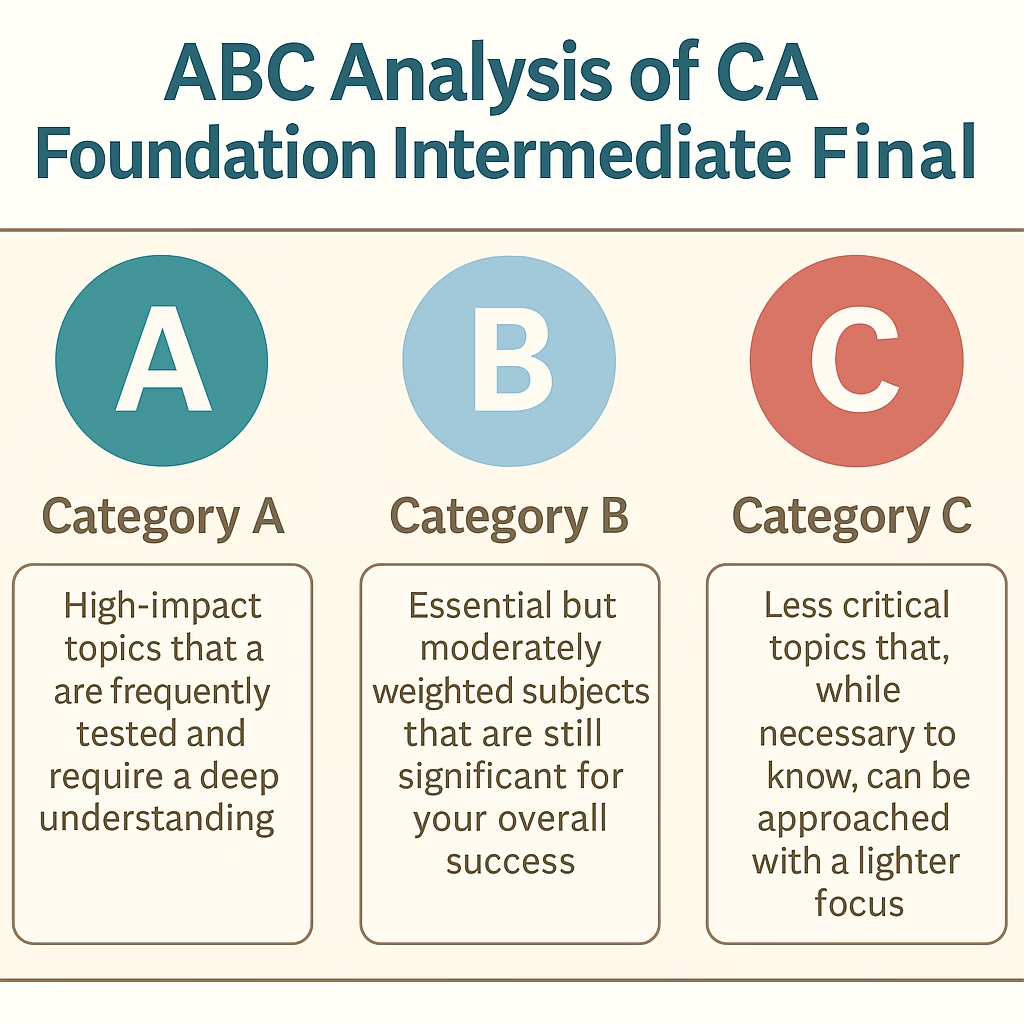

ABC Analysis of CA is a proven strategy used to simplify your preparation by categorizing all chapters based on their weightage and importance. Whether you’re preparing for CA Foundation, CA Intermediate, or CA Final, this strategy helps you focus your time and energy where it matters most.

How Does ABC Analysis of CA Work?

- Category A: High-impact topics (50–70% marks)

- Category B: Moderate importance (25–35%)

- Category C: Low weightage (15–20%), revise in the end

Students often struggle with managing the vast CA syllabus. That’s where ABC Analysis of CA gives you an edge. Instead of spreading your effort evenly, this method helps you concentrate more on chapters that appear frequently and are scoring. It’s about working smart, not just hard.

Many rank holders have relied on ABC categorization to filter their revisions. It’s especially useful during last-month prep, mock test evaluations, and identifying weak zones. You’ll always have clarity on what to revise, and where to focus next.

Plus, using ABC Analysis of CA makes group studies or test series more effective. You and your peers can align your prep and assess each other on priority topics first. This also helps mentors and faculties in guiding students more accurately.

ABC Analysis of CA Foundation

Here is a complete and organized summary of the ABC Analysis for CA Foundation, covering every topic from the table without skipping anything:

📘 1. Principles and Practice of Accounting

✅ Category A (55 to 70 Marks) – High Priority Chapters

- Rectification of Errors

- Bank Reconciliation Statement

- Inventories

- Depreciation and Amortisation

- Bills of Exchange and Promissory Notes

- Final Accounts of Non-Manufacturing Entities

- Final Accounts of Manufacturing Entities

- Admission of New Partner

- Retirement of Partner

- Death of Partner

- Dissolution of Partnership Firm and LLPs

- Issue, Forfeiture and Re-Issue of Shares

- Issue of Debentures

- Accounting for Bonus Issue and Right Issue

- Redemption of Preference Shares

- Redemption of Debentures

⚠️ Category B (25 to 35 Marks) – Moderate Priority Chapters

- Accounting Concepts, Principles and Conventions

- Capital and Revenue Expenditure and Receipts

- Trial Balance

- Cash Book

- Financial Statements of Non-for-Profit Organisations

- Accounts from Incomplete Records

🟡 Category C (15 to 20 Marks) – Lower Priority Chapters

- Meaning and Scope of Accounting

- Contingent Assets and Contingent Liabilities

- Accounting Policies

- Accounting as a Measurement Discipline – Valuation Principles, Accounting Estimates

- Accounting Standards

- Basic Accounting Procedures – Journal entries

- Ledgers

- Subsidiary Books

- Introduction to Partnership Accounts

- Treatment of Goodwill in Partnership Accounts

- Introduction to Company Accounts

📗 2. Business Laws

✅ Category A

- Consideration

- Other Essential Elements of A Contract

- Performance of Contract

- Conditions & Warranties

- Transfer of Ownership and Delivery of Goods

- Relations of Partners

- Registration and Dissolution of a Firm

- The Companies Act, 2013

⚠️ Category B

- Nature of Contract

- Contingent and Quasi Contracts

- Contract of Indemnity and Guarantee

- Bailment and Pledge

- Agency

- Unpaid Seller

- General Nature of Partnership

🟡 Category C

- Indian Regulatory Framework

- Breach of Contract and its Remedies

- Formation of the Contract of Sale

- The Limited Liability Partnership Act, 2008

- The Negotiable Instruments Act, 1881

📙 3. Quantitative Aptitude

✅ Category A

Mathematics:

- Ratio

- Proportion

- Indices

- Simple Interest

- Compound Interest

- Linear Equations

- Cubic Equations

- Arithmetic Progression

- Geometric Progression

- Sets, Functions and Relations

Logical Reasoning:

- Number Series, Coding and Decoding, and Odd Man Out

- Direction Tests

- Seating Arrangements

- Blood Relations

Statistics:

- Statistical Description of Data

- Measures of Central Tendency and Dispersion

- Index Number

⚠️ Category B

Mathematics:

- Logarithms

- Annuity

- Quadratic Equations

- Basic Concepts of Permutations and Combinations

Statistics:

- Probability

🟡 Category C

Mathematics:

- Basics of Limits and Continuity

- Basic Concepts of Differential and Integral Calculus

Statistics:

- Sampling

- Theoretical Distributions

📕 4. Business Economics

✅ Category A

- Nature & Scope of Business Economics

- Theory of Demand and Supply

- Theory of Production and Cost

- Determination of National Income

- Money Market

⚠️ Category B

- Price Determination in Different Markets

- Public Finance

- International Trade

🟡 Category C

- Business Cycles

- Indian Economy

ABC Analysis of CA Intermediate

📘 1. Advanced Accounting

✅ Category A (50–55 Marks) – High Priority

Financial Statements of Companies

Amalgamation (including AS 14)

Accounting Standards for Consolidated Financial Statements (AS 21, 23, 27)

Accounting for Reconstruction of Companies

AS 13: Investment

AS 3: Cash Flow Statements

⚠️ Category B (30–35 Marks) – Moderate Priority

Accounting for Branches including Foreign Branches

Buyback of Securities

AS 20: Earnings Per Share

AS 2: Inventories

AS 10: Property, Plant and Equipment

AS 16: Borrowing Costs

AS 19: Leases

AS 15: Employee Benefits

AS 11: Effects of Changes in Forex Rates

AS 9: Revenue Recognition

AS 12: Accounting for Government Grants

AS 29: Provisions, Contingent Liabilities and Contingent Assets

AS 7: Construction Contracts

AS 22: Accounting for Taxes on Income

🟡 Category C (15–20 Marks) – Low Priority

AS 4: Contingencies and Events after Balance Sheet Date

Introduction to Accounting Standards

Framework for Preparation & Presentation of Financial Statements

Applicability of Accounting Standards

AS 1: Disclosure of Accounting Policies

AS 17: Segment Reporting

AS 18: Related Party Disclosures

AS 24: Discontinuing Operations

AS 25: Interim Financial Reporting

AS 26: Intangible Assets

AS 28: Impairment of Assets

AS 5: Net Profit or Loss, Prior Period Items and Changes in Accounting Policies

📗 2. Corporate and Other Laws

✅ Category A

The Limited Liability Partnership Act, 2008

The General Clauses Act, 1897

The Foreign Exchange Management Act, 1999

Share Capital and Debentures

Management and Administration

Accounts of Companies

⚠️ Category B

Companies Incorporated Outside India

Declaration and Payment of Dividend

Interpretation of Statutes

🟡 Category C

Prospectus and Allotment of Securities

Preliminary

Incorporation of Company and Matters Incidental Thereto

Acceptance of Deposits by Companies

Registration of Charges

📙 3. Direct & Indirect Taxation

✅ Category A

Income Tax:

Residence and Scope of Total Income

Salaries

Profits and Gains of Business or Profession

Deductions from Gross Total Income

Advance Tax, TDS & Introduction to TCS

GST:

Supply under GST

Exemptions from GST

Time of Supply

Value of Supply

Input Tax Credit

Payment of Tax

⚠️ Category B

Income Tax:

Income from House Property

Capital Gains

Income from Other Sources

Aggregation of Income, Set-off and Carry Forward of Losses

Filing of Return of Income and Self-Assessment

GST:

Registration

Charge of GST

Place of Supply

TDS and TCS

E-Way Bill

🟡 Category C

Income Tax:

Basic Concepts

Incomes Exempt from Total Income

Computation of Total Income and Tax Payable

Income of Other Persons included in Assessee’s Income

GST:

GST in India – An Introduction

Returns

Tax Invoice: Credit and Debit Notes

Accounts and Records

📕 4. Cost and Management Accounting

✅ Category A

Material Cost

Employee Cost

Overheads – Absorption Costing Method

Cost Sheet

Marginal Costing

Standard Costing

Budget and Budgetary Control

⚠️ Category B

Activity Based Costing

Service Costing

Process and Operation Costing

Joint Product & By-Product

🟡 Category C

Introduction to Cost and Management Accounting

Cost Accounting System

Unit and Batch Costing

Job Costing

📒 5. Auditing and Ethics

✅ Category A

Risk Assessment and Internal Control

Audit of Items of Financial Statements

Audit of Different Types of Entities

Audit Evidence

Audit of Banks

⚠️ Category B

Nature, Objective and Scope of Audit

Audit Report

Completion and Review

Audit Documentation

🟡 Category C

Ethics and Terms of Audit Engagement

Audit Strategy, Planning and Programme

📓 6. Financial Management & Strategic Management

✅ Category A

FM:

Investment Decisions

Cost of Capital

Management of Working Capital

Financing Decisions – Capital Structure

SM:

Introduction to Strategic Management

Strategic Analysis: External Environment

Strategic Choices

⚠️ Category B

FM:

Financial Analysis & Planning – Ratio Analysis

Financing Decisions – Leverages

Dividend Decisions

SM:

Strategy Implementation and Evaluation

🟡 Category C

FM:

Scope and Objectives of Financial Management

Types of Financing

SM:

Strategic Analysis: Internal Environment

ABC Analysis of CA Final

📘 1. Financial Reporting (FR)

✅ Category A (50–55 Marks) – High Priority

Ind AS 109 (Financial Instruments)

Ind AS 102 (Share Based Payment)

Ind AS 103 (Business Combinations)

Ind AS 115 (Revenue from Contracts with Customers)

Ind AS 116 (Leases)

Conceptual Framework for FR under Ind AS

Professional & Ethical Duty of a CA

Ind AS 33 (EPS)

Ind AS 36 (Impairment of Assets)

Ind AS 12 (Income Taxes)

Analysis of Financial Statements

Ind AS 110, 28, 111 (Consolidated Financial Statements)

⚠️ Category B (30–35 Marks) – Moderate Priority

Ind AS 108 (Operating Segments)

Ind AS 8 (Accounting Policies, Changes in Estimates & Errors)

Ind AS 21 (Foreign Exchange Rate)

Ind AS 7 (Cash Flow)

Ind AS 16 (PPE)

Ind AS 23 (Borrowing Cost)

Ind AS 19 (Employee Benefits)

Ind AS 41 (Agriculture)

Ind AS 2 (Inventories)

🟡 Category C (15–20 Marks) – Low Priority

Ind AS 101, Accounting & Technology, Ind AS 38, Ind AS 113

Ind AS 10, 37, 24, Introduction to Ind AS

Ind AS 40, 1, 34, 105, 20

📗 2. Advanced Financial Management (AFM)

✅ Category A

Security Valuation

Portfolio Management

Mutual Funds

Business Valuation

Mergers, Acquisitions & Corporate Restructuring

Derivatives Analysis and Valuation

Advanced Capital Budgeting Decisions

Financial Policy

Risk Management

Securitization

Startup Finance

⚠️ Category B

Interest Rate Risk Management (IRRM)

International Financial Management (IFM)

🟡 Category C

Forex

Security Analysis

📙 3. Advanced Auditing, Assurance and Professional Ethics

✅ Category A

SA (SQC 1, 240, 250, 299, 315, 505, 540, 550, 560, 570, 620, 701, 705, 720, 800)

Professional Ethics

Prospective Financial Information & Other Assurance Services (SAE)

Digital Auditing & Assurance

Emerging Areas: SDG & ESG Assurance

Group Audits

Audit of Public Sector Undertakings

Reporting (CARO & framing of reports)

⚠️ Category B

SA (220, 265, 320, 330, 402, 501, 520, 530, 610, 706, 805)

Internal Audit

Review of Financial Information (SRE)

Related Services (SRS)

Audit of Banks

Investigation & Forensic

🟡 Category C

SA (200, 210, 230, 260, 300, 450, 500, 510, 580, 600, 700, 710, 810)

NBFC

Due Diligence

Risk Assessment & Internal Control

📕 4. Direct Tax Laws and International Taxation

✅ Category A

Double Tax Relief

Transfer Pricing

NR Taxation

Equalisation Levy

PGBP

Various Entities

Charitable Trust

TDS & TCS

The Black Money & Imposition of Tax Law

⚠️ Category B

Capital Gains

IFOS

Miscellaneous Provisions

GAAR (Tax Planning, Evasion & Avoidance)

Return Filing & Assessment Procedure

Tax Audit and Ethical Compliances

Appeals & Revision

🟡 Category C

Advance Rulings

Dispute Resolution

Income Tax Authorities

Penalties and Prosecution

Setoff

Clubbing

Basic Concepts & Exempt Income

Tax Treaties Interpretation

BEPS Fundamentals

Model Tax Conventions Overview

Latest Developments in International Taxation

Case Law

📒 5. Indirect Tax Laws (GST + Customs)

✅ Category A

GST:

Supply under GST

Charge under GST

Exemption from GST

Value of Supply

Input Tax Credit

Registration

Refund under GST

Assessment and Audit

Demand and Recovery

Offence, Penalty & Ethical Aspects

Customs:

Safeguard Duty and Anti-Dumping Duty

Levy and Exemption

Valuation under Customs

Import and Export under Customs

⚠️ Category B

GST:

Time of Supply

Place of Supply

Account & Records, E-Way Bill

Import & Export under GST

Appeals & Revision

Payment of Tax

Advance Ruling

Customs:

Warehousing

Foreign Trade Policy

🟡 Category C

GST:

Tax Invoice, Debit & Credit Notes

Returns

Inspection, Search and Seizure

Liability in Certain Cases

Job Work

Miscellaneous Provisions

Customs:

Classification

Refund under Customs

📓 6. Integrated Business Solution

⚪ Not Applicable (No A/B/C categorization for this paper)

Why ABC Analysis of CA is Your Shortcut to Success

- Smart prioritization saves time

- Focused revision boosts scores

- Exam clarity reduces stress

Join our CA Test Series – Practice tests mapped with ABC chapters.

📘 Join 10,000+ CA Students Using Our Test Series