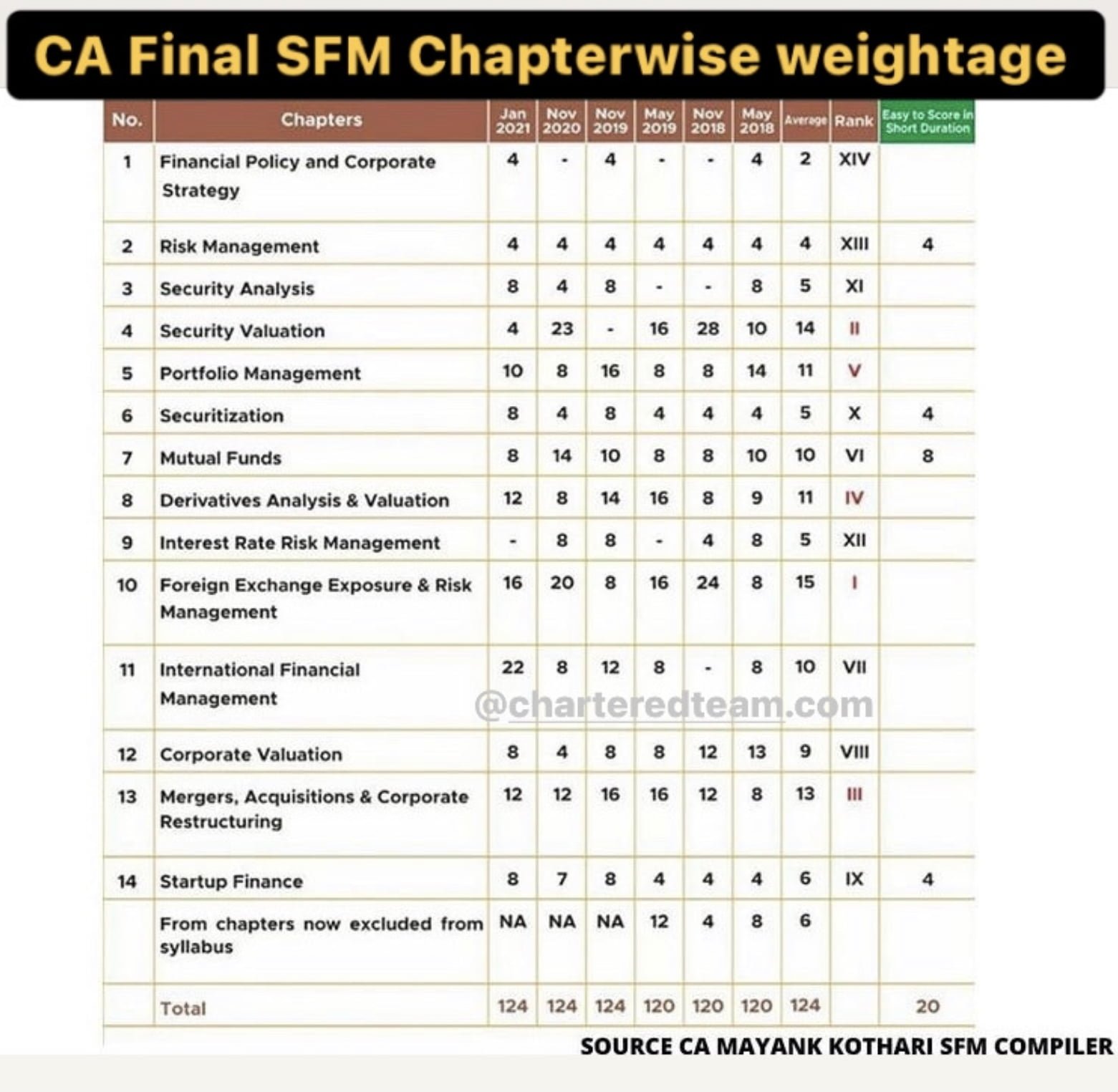

SFM Chapter-wise weightage

SFM chapter-wise weightage

Nov 19 New syllabus SFM Chapter-wise weightage

Sr No | Chapter | Marks |

| 1. | Financial Strategy | 4 Marks |

| 2. | Security analysis | 8 Marks |

| 3. | Security Valuation | 8 Marks |

| 4. | Mergers and Acquisition | 8 Marks |

| 5. | Mutual Funds | 10 Marks |

| 6. | Forex | 8 Marks |

| 7. | Futures | 22 Marks |

| 8. | Portfolio | 16 Marks |

| 9. | International Capital Budgeting | 12 Marks |

| 10. | Business Valuation | 8 Marks |

| 11. | Start up Finance | 8 Marks |

| 12. | Securitization | 4 Marks |

| 13. | Value at risk | 4 mark |

Click here for CA Final RTP | Past Papers | Amendments | MCQ booklet Everything at one place

Question wise marks and comments

| Question No | Marks | Chapter | Comments |

| 1 – A | 8 | Mergers and Acquisition | A very basic Question with basic calculations |

| 1 – B | 8 | Derivatives – FRA | repeat the past paper question |

| 1 – C | 4 | Start up Finance – Theory | A question from the text book |

| 2 – A | 10 | Mutual Funds | repeat the past paper question |

| 2 – B | 6 | Derivatives – Futures | A question based on Cost of carry model. For me 6 marks are a bit high for this question. |

| 2 – C | 4 | Securitization – Theory | A question right from the text book |

| 3 – A | 8 | Derivatives – Option | A good Question – We need little bit of thinking on this question. |

| 3 – B | 8 | Security Analysis | repeat the past paper question |

| 3 – C | 4 | Start up – Theory | Last question on start up – again from text book. |

| 4 – A | 8 | Security Valuation | Students will have to work it out with some common sense. |

| 4 – B | 8 | Forex | Surprisingly forex was low on this paper and even this question is a repeat. |

| 4 – C | 4 | VAR | Very basic question. |

| 5 – A | 8 | Portfolio | Have we not seen this question being repeated atleast 5 times in past. Stop it NOW. |

| 5 – B | 8 | International Capital Budgeting | Happy to see the question where students will have to read it more than twice and will have to put thinking hat on. Every mark is worth. This should have been in Compulsory List. |

| 5 – C | 4 | Financial Strategy -Theory | Right from study material. |

| 6 – A | 8 | Portfolio | Second question from this chapter. We could have avoided this and put another question from forex instead. |

| 6 – B | 8 | Business valuation | Knowledge of 2 stage model is needed and also some good reading for proper interpretation. |

| 6 – C | 4 | Securitization / International Capital Budgeting – Theory | From study Material |

SFM Paper

Click here for CA Final Amendments /RTPs / Mock Tests and MCQs compilation

If you are having upcoming CA Exams then must follow this Schedule