Zero Marks in Audit? Discover the Real Reasons and Fix Them Now!

How to Avoid Zero Marks in Audit: Proven Strategies for CA Final Success

Getting zero marks in audit in CA Final can feel like a punch in the gut — especially after months of preparation. But here’s the reality: many students unknowingly repeat the same mistakes. The good news? You can fix it.

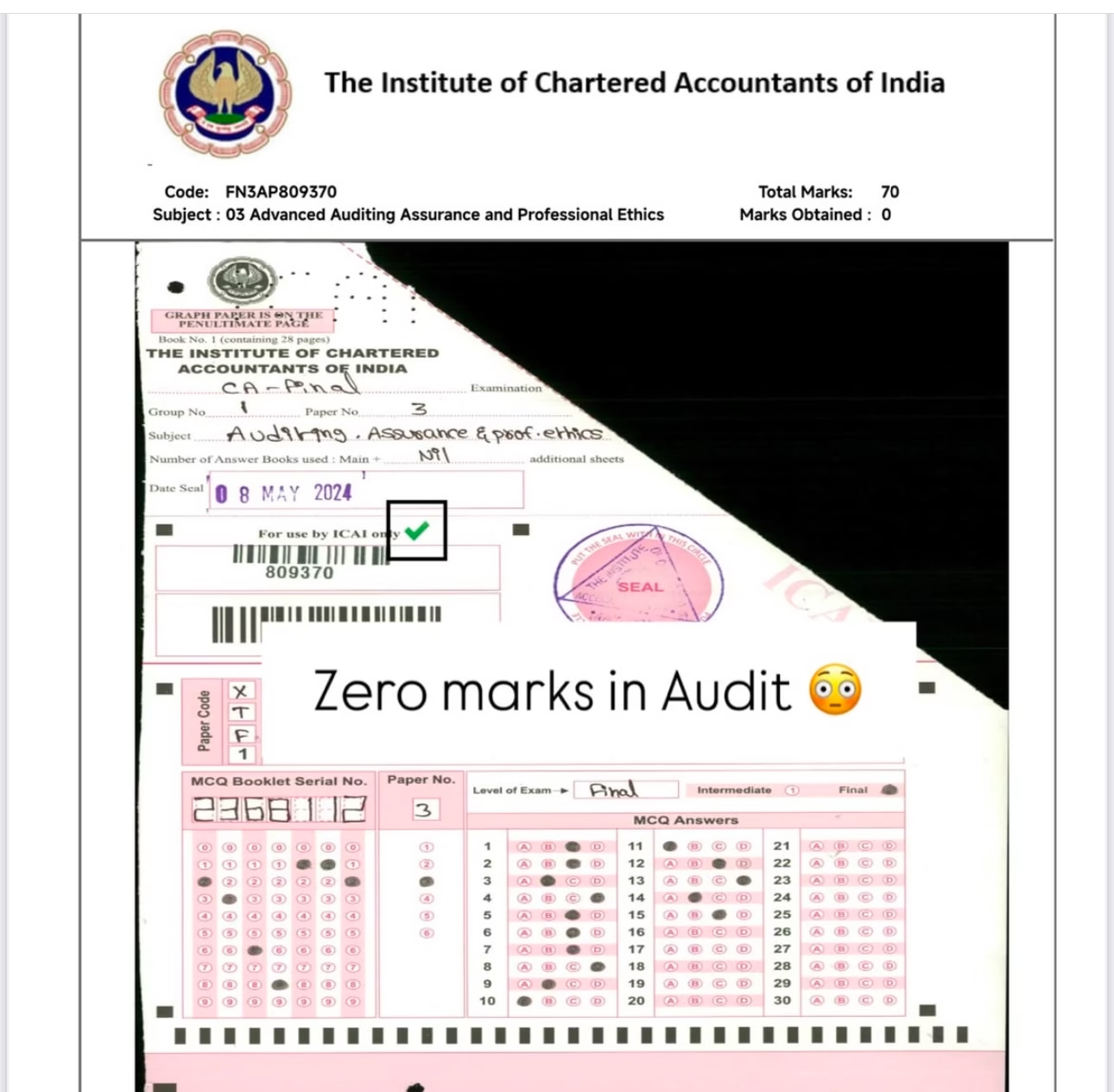

Below, we’ve added below two certified copies — one with zero marks, and one from an AIR 1 ranker. Use this comparison and our expert insights to change your exam outcome.

📄 Zero Marks in Audit – Real ICAI Certified Copy

🌟 AIR 1 Audit Copy – Learn What Top Scorers Do Differently

Top 7 Mistakes That Lead to Zero Marks in Audit

1. Conceptual Confusion

Audit is not about memory — it’s about logical application. Without understanding the core of audit procedures, your answers will fall flat.

2. Not Quoting SA Numbers

Students often lose marks for missing SA references. Mentioning the correct SA number and title shows depth and technical knowledge.

3. Writing General Answers

Terms like “business loss” or “general review” are not audit-specific. Use audit terms: material misstatement, audit opinion, sufficient appropriate evidence, etc.

4. Poor Presentation

Long paragraphs = poor readability. Use bullets, headings, and underline keywords. Think like an evaluator.

5. Skipping Ethics & Company Audit

Ethics is high-scoring with minimal effort. Students who skip it miss out on 8–12 easy marks.

6. Not Referring ICAI RTPs

ICAI language is key. Refer RTPs, MTPs, and ICAI case laws while writing — or risk getting ignored by the examiner.

7. Time Mismanagement

Writing great answers in Q1 and leaving Q6 blank leads to disaster. Practice 100-mark mocks with a stopwatch to master timing.

✅ How to Never Get Zero Marks in Audit Again

- ✔️ Quote correct SAs and apply provisions

- ✔️ Use ICAI terms from RTP/MTP

- ✔️ Structure well: intro → provision → application → conclusion

- ✔️ Practice time-bound test papers

- ✔️ Attempt ALL chapters: Ethics, LLP Audit, Amendments

🚀 Want Feedback Like AIR 1 Got?

We’ve helped thousands avoid zero marks in audit by practicing the right way. Our CA Test Series gives you structured tests, detailed feedback, and exact improvement points.

👉 Click here to enroll and never fear Audit again

📲 Follow us on Instagram: @charteredteam