Best Test Series for CA CMA CS – Practice Smarter, Score Higher

📝 What’s Covered in Our Test Series for CA CMA CS-

📚 CA Test Series

📘 CMA Test Series

📕 CS Test Series

✅ Why Choose Our Test Series for CA CMA CS?

Here’s what you get when you enroll:

- 📘 5 Total Tests per Subject: 4 Chapter-wise (30 marks) + 1 Full syllabus (100 marks)

- 📅 Flexible Scheduling: Get all papers at once, solve as per your comfort

- 🕒 48-Hour Evaluation: Papers checked by qualified Chartered Accountants

- 📞 Doubt Support: We solve all academic doubts via mail & WhatsApp

- 🎯 Exam Pattern: Fully aligned with ICAI, ICMAI, and ICSI latest formats

💡 Who Should Join This Test Series?

This Test Series for CA CMA CS is perfect for:

- 📖 Self-study students looking for structure and targets

- 🧑🏫 Coaching students who want additional writing practice

- 🎓 Repeaters who want to improve accuracy and presentation

📦 How Test Series for CA CMA CS Works

- ✅ Enroll via the product link

- 📩 Get access to all tests within 24 hours

- 🖊️ Write on paper, scan with mobile app

- 📤 Email your answer sheets to: charteredteams@gmail.com

- 📝 Get detailed evaluated PDF within 48 hours

Appearing for CA, CMA, or CS exams? You already know that studying theory isn’t enough. Practicing under real exam conditions is the key to confidence and accuracy. That’s why more than 10,000 students trust our Test Series for CA CMA CS to boost their performance and crack these professional exams.

In this blog, you’ll find everything about our test series – its structure, benefits, how it’s evaluated, and most importantly, why it’s trusted by toppers.

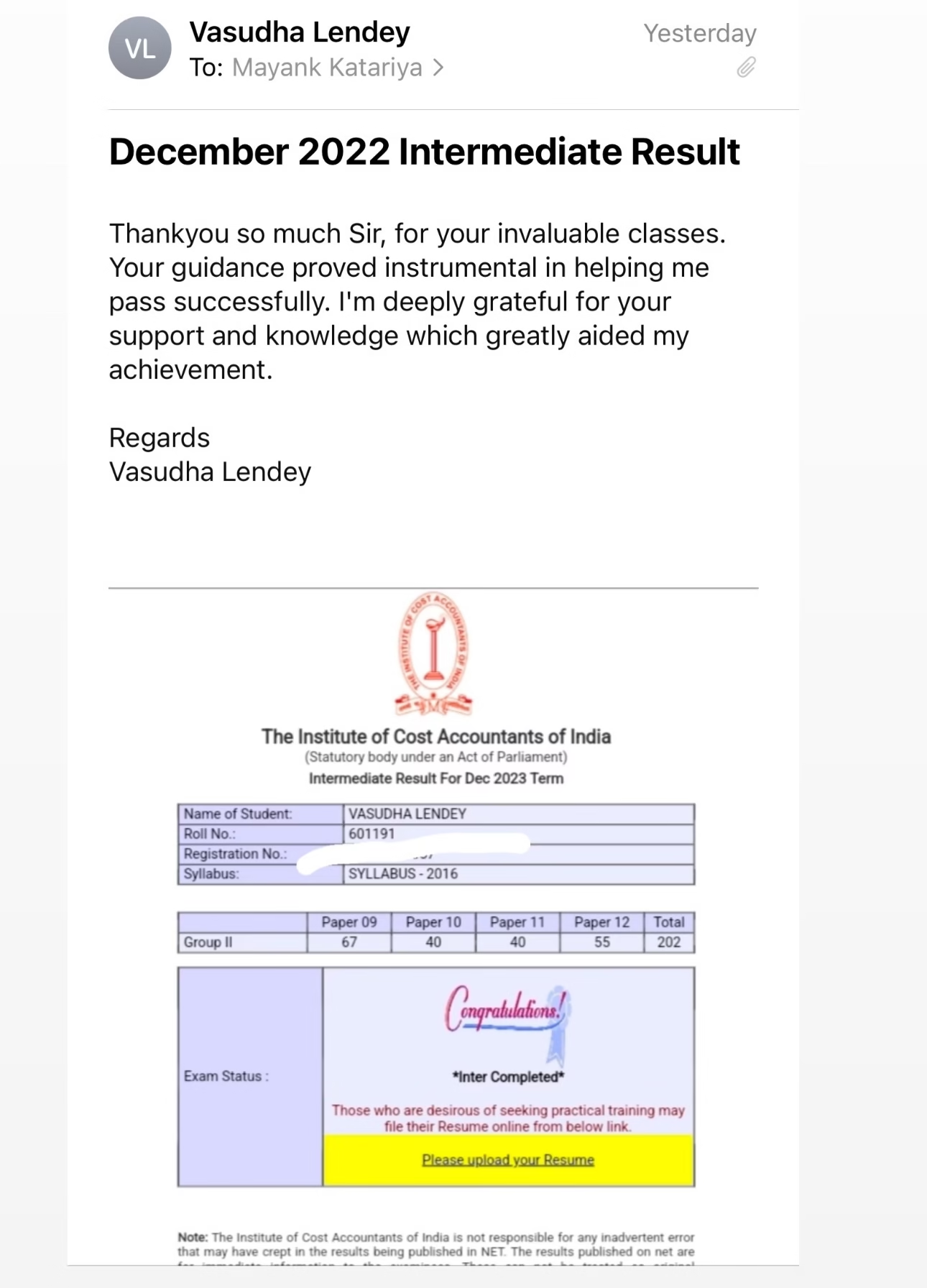

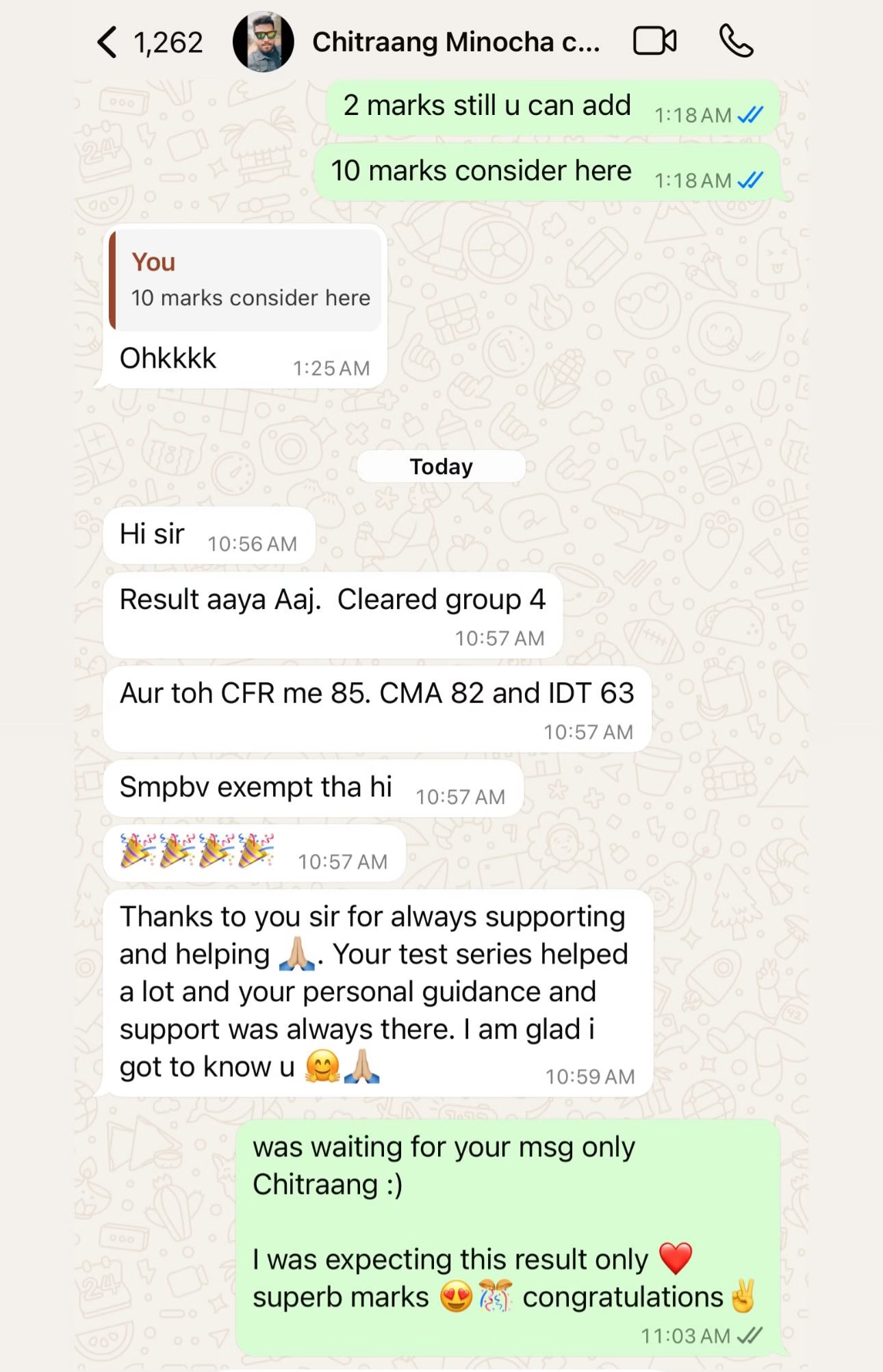

CMA Test Series Reviews

CMA Test Series Reviews

📈 Real Benefits – Why It Actually Helps You Score Better

- 👉 You learn time management with 3-hour mock tests

- 👉 Expert feedback highlights your writing mistakes

- 👉 You stay on track with weekly goals

- 👉 You improve your ICAI-style presentation

📌 Recommended Reading & Resources

💬 FAQs – Your Doubts, Answered

1. Can I write the tests at my own time?

Yes, all tests are shared at once. You can write any test on any day before exams.

2. Will I get my answer sheets evaluated?

Yes, by our team of qualified Chartered Accountants within 48 working hours.

3. Are doubts solved during the test series?

Absolutely! You can ask doubts anytime during your test series via WhatsApp or Email.

🚀 Final Words: Join the Best Test Series for CA CMA CS Today

Whether you’re appearing for CA Foundation, CMA Inter, or CS Executive – this is your chance to turn practice into performance. Our Test Series for CA CMA CS is built to push you forward, correct your mistakes, and build confidence before the exam day.

Enrol Now and Get 5 Tests Per Subject + 48 Hour Evaluation + Full Doubt Support.

📚 CA Test Series

📘 CMA Test Series

📕 CS Test Series

📲 Contact: 8005601309 | Follow on Instagram